Senator Mitch McConnell's financial disclosures, including details of his income, are public records. These records provide transparency into his financial interests as a public figure. They reveal sources of income, such as capital gains, investments, and potentially compensation for his role as a senator, allowing for analysis of potential conflicts of interest or adherence to ethical standards.

Public access to such financial information is crucial in a democratic society. It allows citizens to scrutinize the financial dealings of elected officials, fostering public trust and accountability. By revealing the sources of a senator's wealth, the information can spark discussions regarding potential biases or undue influence stemming from financial interests. The public scrutiny of such records is a cornerstone of responsible governance and helps hold elected officials accountable.

Further analysis of Senator McConnell's specific financial records would likely involve examining historical trends, comparing income figures across different years, and drawing parallels with other public figures or historical precedents. This analysis could inform discussions about legislative reforms, ethical standards, and the potential impact of campaign financing.

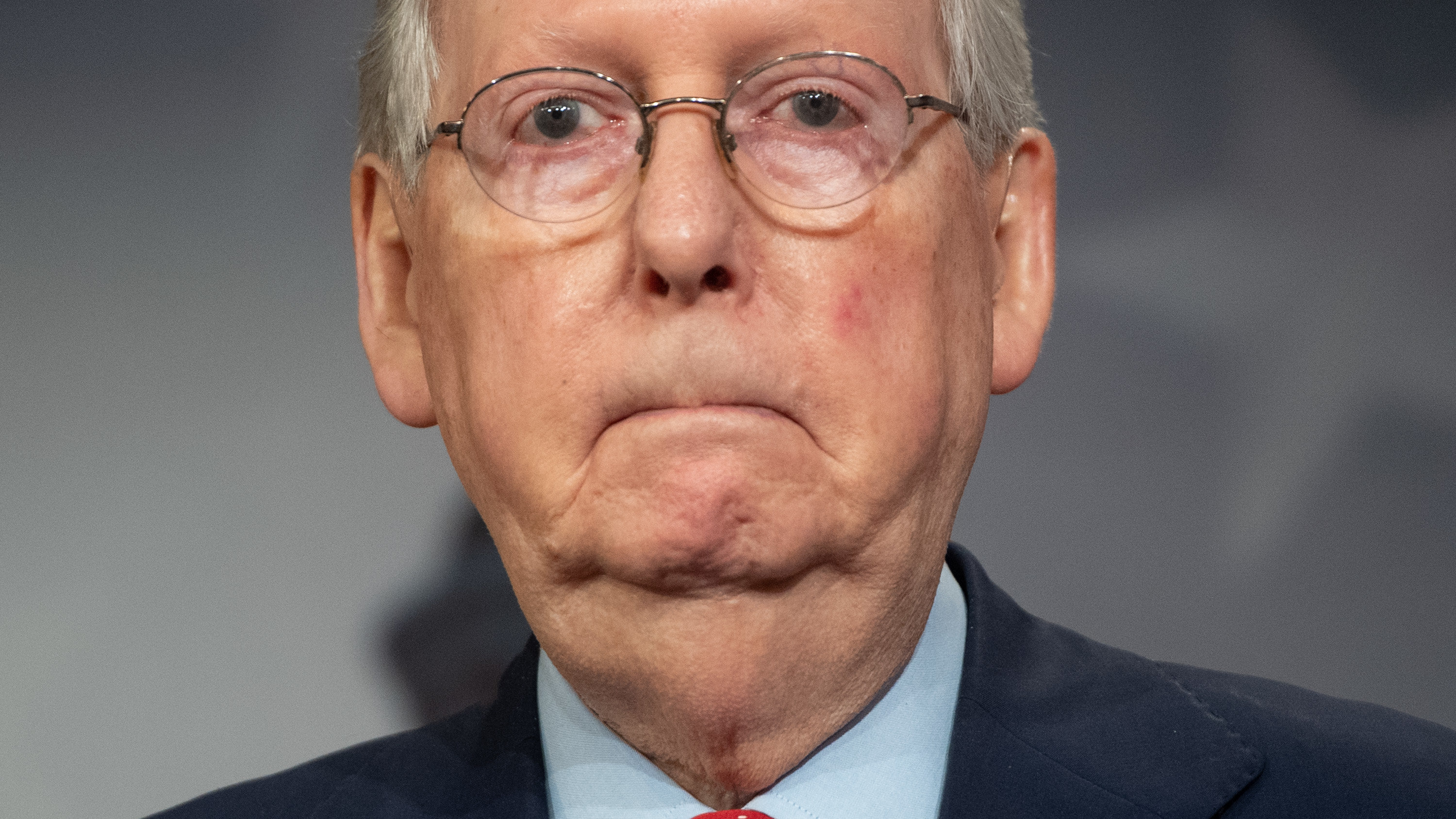

Mitch McConnell's Income Tax

Public financial disclosures of senators, including income tax information, are a vital component of transparency and accountability in governance. These disclosures enable the public to understand the financial interests of their elected officials.

- Financial disclosure

- Public records

- Tax reporting

- Potential conflicts

- Ethical standards

- Public trust

- Accountability

These aspects, taken together, reveal the public's right to know about a senator's financial dealings. Senator McConnell's income tax filings, as public records, illuminate potential conflicts of interest, if any. Transparency fostered by these records builds public trust and accountability, ensuring that elected officials operate within acceptable standards. A senator's disclosure of income can be compared to other senators' or public figures' income, to provide context and potentially reveal patterns. This information is crucial to evaluating ethical practices in public office.

1. Financial Disclosure

Financial disclosure, in the context of public figures like Mitch McConnell, refers to the public release of financial information. This includes details about income sources, assets, and liabilities. The disclosure of Senator McConnell's income tax information is a component of this broader practice, offering insights into potential conflicts of interest or financial motivations.

- Transparency and Accountability

The core function of financial disclosure is to enhance transparency and accountability in public office. The public's right to know about the financial affairs of their representatives helps ensure elected officials act in the public interest. In the case of Mitch McConnell, this disclosure allows for evaluation of potential conflicts between personal financial interests and official duties.

- Potential Conflicts of Interest

Financial disclosure provides a mechanism for identifying potential conflicts of interest. Analyzing the sources and nature of income can reveal connections between financial holdings and official actions. For example, significant holdings in specific industries could potentially influence legislative decisions, raising questions of impartiality.

- Historical Context and Comparison

Comparing Senator McConnell's financial disclosure with those of other elected officials, or with historical records, can provide context. This comparative analysis can shed light on trends, potential biases, or unusual patterns. Such comparisons are valuable for understanding the broader picture of financial interests in public service.

- Public Trust and Perception

Public disclosure of income tax information, such as that for Senator McConnell, directly influences public trust. Clear and readily available financial information fosters a sense of accountability and reduces suspicion, enhancing the perception of ethical conduct in government.

In summary, financial disclosure, exemplified by Senator McConnell's income tax information, plays a critical role in maintaining transparency and accountability in public life. The availability of this information facilitates scrutiny and analysis, enhancing public trust and upholding ethical standards in political decision-making.

2. Public records

Public records, encompassing official documents accessible to the general public, are fundamental to democratic governance and transparency. In the context of Senator Mitch McConnell's income tax filings, public records serve as the crucial mechanism for disclosing financial information. This disclosure is a direct consequence of legal requirements and ethical expectations surrounding public service. The availability of these records enables the public to scrutinize potential conflicts of interest and evaluate the financial dealings of elected officials.

The significance of public records in this context lies in their role as a check on power. Individuals and organizations can examine the records to identify potential financial motivations influencing policy decisions or actions. For example, large contributions from certain sectors or individuals might raise questions about whether legislative agendas are aligned with those private interests. The existence of public records ensures a measure of accountability and potentially prevents the abuse of power. This scrutiny contributes to a more informed citizenry capable of making informed decisions about their representation.

The availability of public records regarding income tax information fosters transparency. It allows for a comparison between disclosed income and reported political actions or policy positions. Such analysis, while not conclusive, can raise questions and generate public discussion about potential conflicts. By making such information accessible, a foundation for public discourse is laid, enabling evaluation of the alignment between personal finances and public service. The critical function of these records, therefore, is to maintain public trust and foster a system of accountability in elected office.

3. Tax Reporting

Tax reporting, a fundamental aspect of financial compliance, is inextricably linked to Senator Mitch McConnell's income tax filings. The process of reporting income, deductions, and liabilities is crucial for determining the amount of tax owed to the relevant jurisdiction. In Senator McConnell's case, as with all public officials, this process is subject to public scrutiny, facilitating evaluation of potential conflicts of interest and demonstrating adherence to legal requirements. Tax reporting, in this context, provides a transparent window into financial activities that can be analyzed to assess the senator's financial circumstances and their possible influence on public policy decisions.

Accurate and timely tax reporting is essential for establishing accountability and trust. The public's access to this information allows for comparisons between reported income and publicly available information regarding policy positions or actions. For example, large increases in reported income alongside support for particular legislative proposals might prompt public discussion about potential conflicts. Such scrutiny, while not definitive proof of a conflict, fosters a more informed public discourse on financial interests that may influence political decision-making. The reporting itself, through its meticulous documentation, can, when scrutinized, provide insights into financial practices and potentially expose irregularities or discrepancies.

In conclusion, tax reporting, in the context of public figures like Senator McConnell, is a critical component of financial transparency. It is not merely a compliance activity but a crucial element in maintaining public trust and fostering accountability. The transparency provided by meticulously documented tax reporting can facilitate public scrutiny and discourse, ultimately enhancing the evaluation of financial interests in relation to public office. By adhering to rigorous tax reporting requirements, public figures demonstrate a commitment to transparency and ethical conduct.

4. Potential Conflicts

Senator Mitch McConnell's income tax filings raise the possibility of conflicts of interest. Analyzing these financial records enables the public to assess potential connections between personal financial interests and official actions or policies. This scrutiny is vital for maintaining public trust and ensuring ethical conduct in public service.

- Financial Interests and Policy Positions

Examination of income sources can reveal financial ties to specific industries or entities. Significant holdings in an industry, for example, might raise concerns about potential bias in legislative positions or decisions that affect that industry. This analysis necessitates careful consideration of whether financial interests could unduly influence policy decisions or actions. Potential conflicts arise when the personal financial gain of a public figure appears to align with the outcomes of policies they champion.

- Campaign Funding and Political Influence

Income from campaign donations or other political activities warrants careful attention. A close relationship between financial contributions and policy priorities or legislation can raise concerns about potential influence. The evaluation of potential conflicts in this area necessitates careful consideration of the sources of income and how those sources align with political actions or legislative outcomes. The extent to which financial contributions might influence political decisions is a crucial factor for public analysis and understanding.

- Regulatory and Oversight Roles

The role of financial disclosure, in this case, is to reveal potential influence over regulatory bodies or oversight processes. If Senator McConnell has significant financial interests in entities subject to regulation, there's a potential conflict of interest. The public needs to examine whether personal finances might unduly affect regulatory stances or oversight of specific industries or organizations. This requires thorough evaluation of reported income, particularly from sectors requiring government oversight.

- Objectivity and Impartiality

The core function of elected officials is to act in the public interest, free from personal bias. Financial disclosures allow the public to assess whether personal financial circumstances could compromise objectivity or impartiality. Scrutiny of potential conflicts related to objectivity and impartiality involves analyzing reported income sources in comparison with the positions taken by the senator on relevant legislation or issues.

In conclusion, the potential conflicts arising from Senator McConnell's income tax filings highlight the importance of transparent financial disclosure in public service. Careful analysis of these records allows the public to evaluate potential conflicts of interest and maintain public trust and accountability in political decision-making. The information, when scrutinized alongside public pronouncements and legislative actions, can reveal potential areas for concern and prompt further inquiry. The potential for conflicts of interest is a core concern, requiring careful examination of financial records within their broader political and policy context.

5. Ethical Standards

Ethical standards in public service dictate how elected officials should conduct themselves, including adherence to transparency and accountability. Senator Mitch McConnell's income tax filings are a key element in assessing adherence to these standards. The scrutiny of these financial disclosures helps to ensure that personal financial interests do not unduly influence public policy decisions, upholding public trust and reinforcing a system of responsible governance.

- Transparency and Public Trust

Transparency in financial dealings is a cornerstone of ethical public service. Full and accurate disclosure of income and assets, as exemplified by income tax filings, fosters public trust. Omissions or inaccuracies in such disclosures can undermine confidence in elected officials and potentially signal a lack of integrity. The accessibility of this information enables the public to scrutinize potential conflicts of interest, ensuring accountability.

- Avoiding Conflicts of Interest

Ethical standards demand that public officials avoid conflicts of interest. Examining Senator McConnell's income tax information helps identify potential conflicts. Significant financial holdings in specific industries, for example, could raise questions about potential bias in policy decisions affecting those sectors. The disclosure of income can help illuminate these potential conflicts, promoting discussion and transparency.

- Impartiality and Objectivity

Ethical conduct necessitates impartiality and objectivity in public service. An examination of income sources can assess whether personal financial interests could compromise impartiality. Significant financial gains from certain sources could raise concerns about potential influences on a senator's position on related legislation or policy, affecting objectivity.

- Accountability and Responsibility

Ethical standards establish a framework for accountability. Income tax filings, as part of broader financial disclosures, allow for public scrutiny and evaluation of a senator's adherence to standards of responsible financial management. This accountability mechanism strengthens the public's ability to assess potential conflicts between personal gain and public service.

The application of ethical standards to Senator McConnell's income tax filings underscores the vital role of transparency and accountability in public office. By publicly disclosing financial information, elected officials demonstrate a commitment to ethical conduct and a commitment to serving the public interest. Scrutiny of financial records is crucial for maintaining public trust in a democratic system.

6. Public Trust

Public trust in political figures is a cornerstone of a functioning democracy. This trust stems from the perceived integrity and ethical conduct of elected officials. Senator Mitch McConnell's income tax filings are a component in assessing and maintaining this trust. Public scrutiny of such filings allows the public to evaluate potential conflicts of interest and assess whether a senator's actions align with the public good.

The connection between public trust and Senator McConnell's income tax filings lies in transparency. Openly disclosed financial information enables citizens to assess whether a senator's financial interests might influence their decisions or policies. For example, substantial holdings in a particular industry could potentially raise concerns about bias in legislation affecting that industry. Conversely, the absence of significant conflicts arising from disclosed income might reinforce trust. The transparency provided by these filings allows citizens to form a more informed opinion about the senator's motivations and their potential impact on public policy.

The practical significance of understanding this connection is multifaceted. Public trust is essential for a healthy democracy. When citizens perceive elected officials as acting in their best interests, they are more likely to participate in the political process, engage with their representatives, and support the government. Conversely, a lack of trust can lead to political polarization, decreased voter turnout, and erosion of faith in democratic institutions. Therefore, maintaining and promoting public trust is vital for the ongoing stability and strength of a nation's governance. The transparency provided by Senator McConnell's income tax filings, or similar disclosures for other public officials, is a critical mechanism in cultivating and preserving that trust. Analysis of these records aids the public in assessing the validity of claims about potential conflicts and biases, contributing to a more robust and accountable democracy.

7. Accountability

Accountability, in the context of public figures like Mitch McConnell, is a crucial element in evaluating the ethical conduct and integrity of political officeholders. Income tax filings, as a component of financial disclosure, are integral to evaluating accountability. The public's ability to scrutinize these filings is a key mechanism in ensuring elected officials act in the public interest, free from undue influence or conflicts of interest. This scrutiny is critical, particularly when considering the potential for personal gain to shape legislative actions or policy decisions.

Accountability, when applied to Mitch McConnell's income tax filings, necessitates assessing the correlation between reported income and actions taken in public office. For example, substantial income from specific industries alongside legislative stances potentially favorable to those industries could raise questions about potential conflicts. The public's access to this information allows for evaluation of whether personal financial interests may be influencing policy decisions. Such scrutiny, however, must be conducted responsibly, differentiating between legitimate business dealings and actions that might constitute improper influence. Historical precedents and comparisons with similar financial disclosures can offer context and perspective.

The practical significance of this connection is evident in the potential for public discourse and legislative reform. Thorough analysis of income tax filings, when combined with scrutiny of public statements and voting records, can identify potential areas of concern, prompting deeper investigation and public discussion. This process can contribute to a more informed electorate, encouraging critical evaluation of political figures' actions and fostering greater public participation in democratic processes. Ultimately, accountability, as exemplified by scrutinizing income tax filings, empowers citizens to hold their representatives accountable, strengthening the democratic framework.

Frequently Asked Questions about Mitch McConnell's Income Tax

This section addresses common inquiries regarding Senator Mitch McConnell's income tax filings, aiming for clarity and factual accuracy. Understanding these details is crucial for a nuanced perspective on financial transparency in public office.

Question 1: Why are Senator McConnell's income tax filings publicly available?

Senator McConnell's income tax filings, like those of other elected officials, are often mandated by law or established ethical standards. This public disclosure fosters transparency and accountability, allowing citizens to scrutinize potential conflicts of interest between personal financial interests and official duties.

Question 2: How do these filings relate to potential conflicts of interest?

Analysis of income sources, asset holdings, and other financial details within the filings can reveal potential connections between personal financial interests and legislative actions. Significant holdings in specific industries, for example, might raise concerns about potential bias in policy decisions affecting those industries. However, such analysis does not definitively prove conflict of interest.

Question 3: What is the legal basis for public access to these filings?

The legal basis for public access typically stems from legislation mandating financial disclosure by elected officials. These laws are designed to enhance transparency and accountability in governance. Information in the filings is subject to legal limitations and protections.

Question 4: How should citizens interpret these filings in the context of public policy?

Citizens should view these filings within a broader context. Income sources should be evaluated in conjunction with legislative actions and public statements. Careful consideration of historical precedents and comparisons with other financial disclosures is essential. Such analysis should aim for an informed perspective, avoiding simplistic or biased interpretations.

Question 5: What are the limitations of using income tax filings as a sole measure of ethical conduct?

Income tax filings provide a partial picture. They don't capture the full range of potential influences on legislative decisions or actions. A nuanced understanding requires consideration of other factors, including campaign contributions, lobbying activities, and public statements, as well as context of specific legislative positions.

Question 6: How do these filings contribute to public discourse on accountability?

By making financial information publicly available, income tax filings stimulate public discourse on the potential alignment between personal financial interests and public office responsibilities. This facilitates a more informed citizenry capable of evaluating the actions of elected officials in a more complete and nuanced way.

In conclusion, thoughtful analysis of Senator McConnell's income tax filings, within the larger context of public service and ethical conduct, is crucial for a comprehensive understanding. Transparency in financial disclosure is a vital component of responsible governance. These records, while not conclusive, facilitate public discussion and encourage greater accountability in public office.

The subsequent sections will explore specific legislative actions and public pronouncements in relation to Senator McConnell's financial disclosures.

Tips for Analyzing Senator Mitch McConnell's Income Tax Filings

Analyzing financial disclosures, including income tax filings, of public figures requires a methodical approach. These filings, when viewed critically, offer insights into potential conflicts of interest and illuminate the alignment of personal financial interests with public responsibilities. This section provides practical tips for conducting a rigorous analysis of Senator McConnell's disclosures.

Tip 1: Contextualize the Information. Examine the filings within the broader context of Senator McConnell's career. Consider his legislative positions, voting records, and public pronouncements on relevant issues. This holistic approach helps to identify potential correlations between financial interests and actions. For example, if a significant portion of the senator's income arises from investments in a particular industry, scrutiny should be given to policies affecting that sector. This contextualization helps determine whether personal financial gains might influence official decisions.

Tip 2: Identify Potential Conflicts. Look for significant financial holdings in industries potentially affected by the senator's legislative actions or policy stances. For instance, substantial investments in energy companies might raise concerns if Senator McConnell advocates for policies that favor that sector. This step helps identify possible conflicts, but does not necessarily establish them definitively.

Tip 3: Compare with Similar Disclosures. Examine similar financial disclosures from other public officials, particularly those holding similar positions. This comparison allows for the identification of trends or patterns within the broader political landscape. For example, comparing the income sources and asset holdings of senators from different political parties can reveal potential discrepancies or similarities. These comparisons provide context, enhancing the rigor of analysis.

Tip 4: Evaluate Transparency and Disclosure. Examine the completeness and accuracy of the filings. Omissions or inconsistencies can raise concerns, prompting further investigation. Scrutinizing details such as the source and nature of income and asset valuations helps to assess the transparency of the disclosures. This is a crucial component in determining the reliability of the reported information.

Tip 5: Seek Independent Verification. Where possible, verify information within the filings. This might involve checking public records, industry reports, or expert opinions to ensure the accuracy and context of the disclosed information. This step enhances the objectivity and reliability of the analysis. For example, consulting industry data to corroborate reported income sources can provide further insight.

Tip 6: Avoid Overgeneralization. Do not jump to conclusions based solely on financial disclosures. Correlation does not equal causation. A potential conflict, while important to note, needs further corroboration and analysis to confirm actual conflict of interest. A balanced perspective based on multiple sources of information is essential.

By applying these tips, one can analyze Senator Mitch McConnell's income tax filings with greater precision and objectivity, fostering a better understanding of potential conflicts of interest and promoting accountability in public office.

The subsequent sections will delve deeper into specific examples from the filings, aiming for a more comprehensive analysis within a broader political and historical context.

Conclusion

Examination of Mitch McConnell's income tax filings, as public records, reveals a crucial aspect of transparency and accountability in public service. The analysis highlights the potential for conflicts of interest when financial interests align with legislative actions. Careful scrutiny of income sources, asset holdings, and reported transactions provides insight into potential connections between personal financial gain and official responsibilities. This scrutiny, though not definitively proving conflict, underscores the importance of financial transparency for maintaining public trust and ensuring that elected officials act in the best interests of the citizenry.

The analysis of these filings, while illuminating potential areas of concern, must be conducted within a comprehensive framework encompassing broader political and historical context. Future research might explore correlations between financial disclosures and specific legislative outcomes. Furthermore, the ongoing practice of financial disclosure by public officials serves as a cornerstone of responsible governance, prompting rigorous evaluation and fostering a climate of accountability in democratic societies. Ultimately, the public's informed engagement with such disclosures is vital in a functioning democracy, promoting transparency and upholding the principles of good governance. This scrutiny is not about assigning blame, but about fostering a more informed and engaged citizenry. Continued vigilant observation and critical analysis of financial disclosures of elected officials are essential for safeguarding democratic principles.

You Might Also Like

Megan Fox's Stunning Yellow Dress: See The Details!Megan Fox's Boyfriend: Secret Details & Latest News

Kourtney Kardashian & Megan Fox: Apple Connection?

Megan Fox Eyes: Stunning Looks & Beauty Secrets

Mitch McConnell, John Lewis Handshake: A Powerful Moment

Article Recommendations